Many construction projects, large or small, tend to face multiple risks. The risks range from work accidents to injuries and property damage that lead to liability claims. The intent of wrap-up insurance is to provide peace of mind that everyone on the project is insured. Think of wrap-up insurance as a blanket coverage for all contractors on the job.

What is wrap-up insurance?

Wrap-up insurance is a comprehensive liability insurance policy specifically made for construction projects that protect all contractors and subcontractors working on large-scale projects. There are typically two types of wrap-up insurance, owner-controlled and contractor-controlled insurance.

General liability insurance coverage generally includes attorney fees, court costs, settlements, and judgments for covered claims made during the coverage period, and typically including completed operations.

What are the two types of wrap-up insurance?

Owner-controlled wrap-up insurance

Owner-controlled wrap-up insurance (OCIP) is initiated by the project’s owner and covers all contractors and subcontractors. This form of insurance typically includes general liability coverage, workers’ compensation and excess liability coverage. The idea behind owner-controlled wrap-up insurance is to protect against various risks associated with construction projects.

Advantages:

- Owners can negotiate better rates based on project scale.

- Coverage can extend across multiple phases or sites.

- Facilitates long-term control over post-completion liability.

Drawbacks:

- Requires significant administrative capacity.

- Owners must manage enrollments, audits, and safety tracking.

Contractor-controlled wrap-up insurance

In similarity to owner-controlled wrap-up insurance, contractor-controlled wrap-up insurance (CCIP) is controlled by the general contractor. This insurance basically covers all subcontractors under the general contractor.

Advantages:

- GCs can tailor coverage to align with their risk management programs.

- Stronger oversight of subcontractors’ safety compliance.

- Easier integration with GC’s own project management systems.

Drawbacks:

- Owners may have limited visibility into the policy structure.

- Some subcontractors may have concerns about relying on GC-controlled coverage.

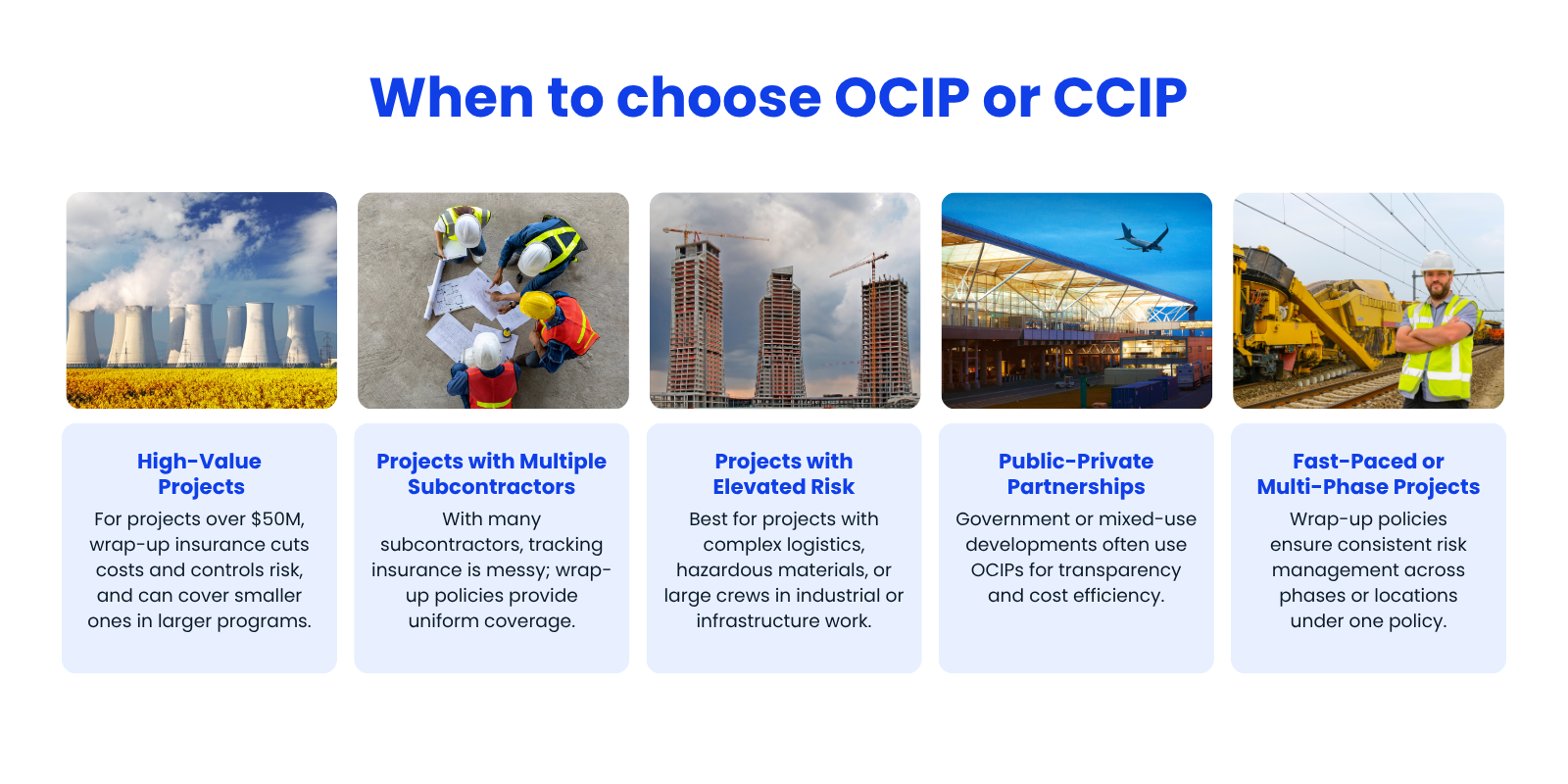

When to Choose a Wrap-Up Insurance Policy

A wrap-up insurance program is most suitable for:

- High-Value Projects

For projects valued at $50 million or more, the potential cost savings and risk control make wrap-up insurance a compelling choice. Some owners may also consider it for smaller projects if they are part of a larger program or portfolio. - Projects with Multiple Subcontractors

When dozens of subcontractors and vendors are involved, coordinating and verifying individual insurance certificates can become chaotic. A wrap-up policy simplifies this process by providing uniform coverage. - Projects with Elevated Risk

Wrap-up policies are ideal in settings with complex logistics, hazardous materials, or large crews, such as industrial, oil & gas, or infrastructure projects, where robust construction risk management insurance is essential. - Public-Private Partnerships

Government-funded or mixed-use developments often favor OCIPs for their transparency and cost efficiency. - Fast-Paced or Multi-Phase Projects

Wrap-up policies help manage risk consistently across multiple phases or geographical sites under a single insurance umbrella.

Ultimately, when to choose wrap-up insurance comes down to project complexity, scale, risk appetite, and internal management resources.

Why do we need wrap-up insurance? The benefits

- Provide a comprehensive support in risk management

- Typically cost efficient

- Provides a broader coverage than most providers

- Drastically improves safety and loss prevention

- Streamlines the claims process

- Helps with compliance and contractor qualifications

- Attractive to subcontractors

- Helps improve project budgeting - predictable costs

- Helps transfer risk

Cost of not having wrap-up insurance

The response to not having wrap-up insurance is very costly. Let's take a look at what are the negatives to not having wrap-up insurance.

- Higher premiums

- Fragmented coverage

- Higher admin burdens

- Higher safety risks and liability

- Difficult managing claims

- Lack of standardization and inconsistencies

- Legal and litigation risks

How do I attain wrap-up insurance?

Securing wrap-up insurance in construction consists of multiple processes but totally worth it. Here’s how to tell you need wrap-up insurance and the processes attaining it.

Step 1: Evaluate project and scope

Step 2: Determine between OCIP and CCIP

Step 3: Engage with Insurance Broker or Consultant

Step 4: Review program and coverage needs

Step 5: Market program to insurers (RFP Process)

Step 6: Compare and negotiate

Step 7: Implement

Step 8: Administer and gain oversight

Step 9: Claim management

Step 10: Final audits/coverage expansions

Challenges and Considerations

Before implementing a wrap-up insurance policy, consider the potential downsides:

- Administrative Complexity

While wrap-ups simplify coverage, they add complexity on the backend. Sponsors must manage enrollments, site-specific endorsements, and claims reporting. A dedicated insurance administrator or third-party consultant is often needed. - Potential for Gaps

Some policies may not extend coverage for off-site work, completed operations, or post-construction liabilities. Tail policies or extended coverage periods may be required. - Subcontractor Resistance

Small or specialized subcontractors may prefer to use their own policies and may not see the benefit of wrap-up participation. Clear communication is essential to avoid delays or disputes. - Cost-Shifting and Audit Risks

If a wrap-up program is funded via back charges or deducts from subcontractor bids, disputes may arise over audit findings or final cost reconciliations.

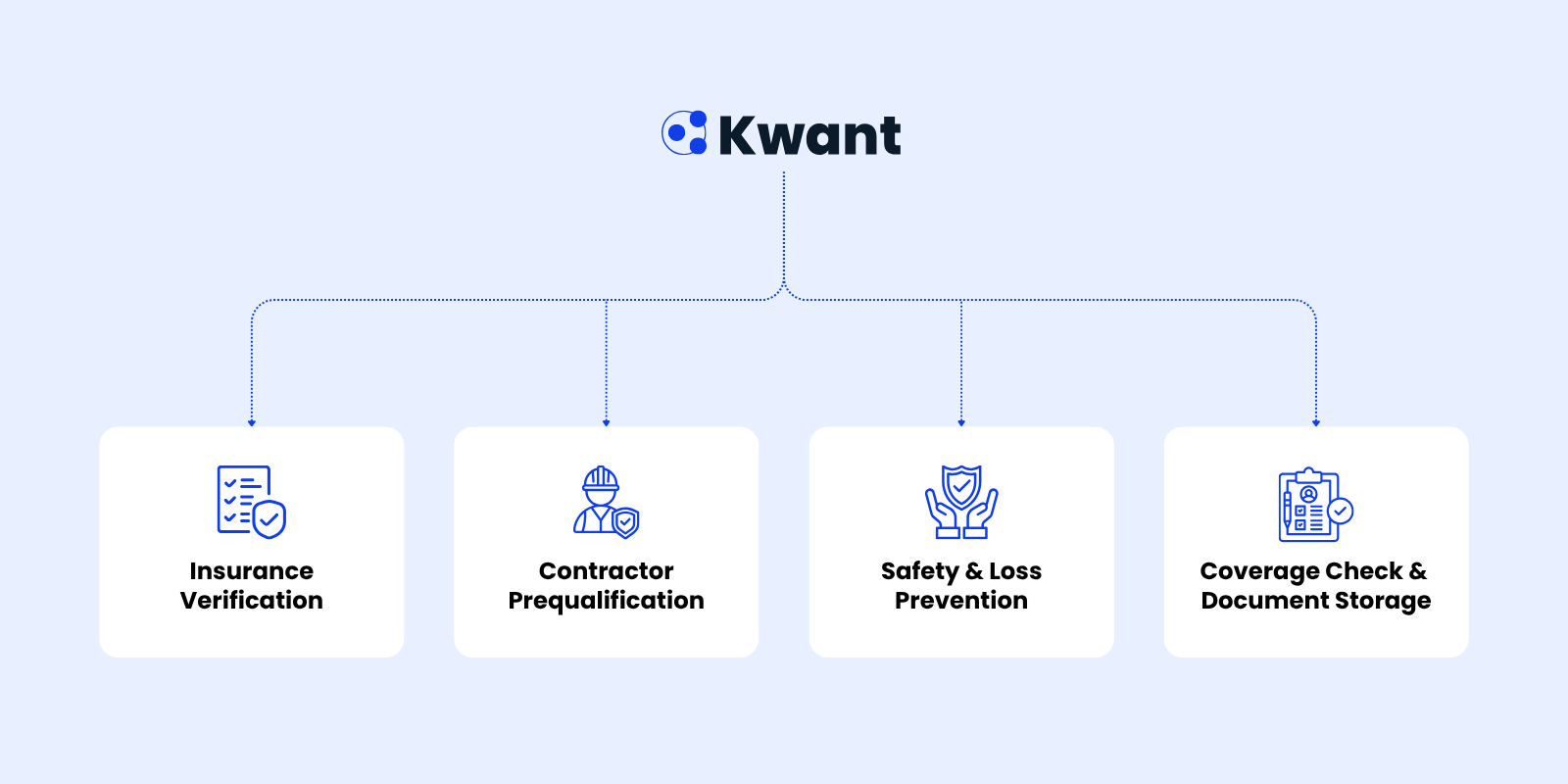

How Kwant Can Help Streamline Wrap-Up Insurance Programs

In large-scale construction, Wrap-Up Insurance Programs (OCIPs and CCIPs) are crucial for managing risk, ensuring compliance, and driving down insurance costs. Injala has demonstrated the power of digitizing enrollment and compliance tracking but Kwant goes even further by offering real-time site data, AI-driven risk control, and automated workforce management that make wrap-ups more effective and transparent.

Here’s how Kwant adds value to wrap-up programs:

Worker Enrollment, Orientation & Document Compliance

Kwant automates the collection of subcontractor and worker data such as COIs, OSHA cards, and safety certifications during onboarding. Workers can complete digital orientation (with embedded quizzes), upload required documents, and receive approval to access the job site without slowing down the schedule.

Verified Timesheets and Payroll Accuracy

Using IoT sensors and smart badges or helmet tags, Kwant verifies when a worker enters and exits the jobsite. This real-time tracking ensures that reported hours match actual presence, allowing wrap-up administrators to verify subcontractor timesheets, reduce payroll fraud, and align wage reporting with real performance. This is especially valuable for insurance audits and payroll-based premium calculations.

Real-Time Risk Control and Incident Prevention

In insurance terms, Risk Control is about proactively reducing the chance of claims and Kwant delivers on this by flagging unsafe conditions, worker fatigue, and access violations. The platform detects trends that increase exposure (such as trades working excessive hours or entering hazardous zones) and notifies supervisors to take corrective action before incidents occur.

Contractor Prequalification with Background Checks

Wrap-up success starts with qualified partners. Kwant supports contractor prequalification by capturing and analyzing company-level data such as safety records, litigation history, EMR, DEI status, and insurance certificates. You can also run background checks or integrate with third-party compliance databases to ensure every subcontractor meets your project’s risk profile before setting foot on-site.

Real-Time Dashboards & Wrap-Up Reporting

Kwant consolidates all relevant data compliance, hours worked, incidents, diversity, and access logs into a single dashboard for project owners, GCs, brokers, and underwriters. Whether it’s a daily wrap-up report, monthly claims analysis, or end-of-project audit, Kwant simplifies it with one-click reporting.

Conclusion: Is Wrap-Up Insurance Right for Your Project?

For owners and general contractors managing large-scale or high-risk builds, a wrap-up insurance construction program can offer significant advantages from consistent coverage and centralized claims handling to cost savings and improved control over safety. Whether through an OCIP or CCIP, choosing the right insurance structure is critical to effective construction risk management.

However, the success of a wrap-up program doesn’t depend on the policy alone, it hinges on how well you manage the workforce, track compliance, and report incidents in real time. That’s where Kwant.ai becomes a powerful asset. By providing unified visibility into labor activity, subcontractor compliance, and site safety, Kwant helps streamline insurance administration and reduce risks across the board.

To learn how Kwant can support your next insured project and help you get the most from your wrap-up policy, reach out to our team or request a demo today.

FAQs

- Who typically controls an OCIP and a CCIP?

An OCIP, or Owner-Controlled Insurance Program, is handled by the project owner usually a developer or public agency who provides insurance for everyone on the site. A CCIP, or Contractor-Controlled Insurance Program, shifts that responsibility to the general contractor, who arranges coverage for all subcontractors involved. - What’s the main goal of implementing a wrap-up insurance program?

The purpose is to bring everyone under one insurance policy. This simplifies coverage, improves coordination, and creates a safer, more efficient project with fewer coverage gaps or disputes. - How does wrap-up insurance contribute to better project safety?

Because everyone shares the same policy, there's a stronger push for consistent safety practices. The sponsor whether it’s the owner or contractor typically oversees safety across the entire site, reducing the chances of underreporting incidents. Wrap-up programs often come with extra resources like safety training, audits, and a streamlined claims process, which makes it easier to prevent injuries and handle issues when they do happen. - How are data-driven risk assessment techniques changing the future of wrap-up insurance?

With tools like predictive analytics, IoT devices, and real-time monitoring, project teams can spot risks before they turn into problems. Insurers can also price policies more accurately and offer better terms. Claims get processed faster, fraud is easier to detect, and contractors can be evaluated based on safety performance across projects making the entire system smarter and more proactive. - What impact do new construction methods, like modular building, have on wrap-up insurance?

Modular construction reduces traditional jobsite risks since much of the work happens off-site in controlled environments. That can mean fewer accidents and lower premiums. But it also introduces new risks, like transporting large modules and assembling them on-site. Insurance programs now have to adapt to cover these shifting exposures and the added complexity of multi-location coordination.

.svg)

.png)

%20(1).svg)